The Gifts of Uncertainty

In 2022, the Business Travel and Mobility industries started very much like the previous two years except for one difference—experience. We were battle tested and knew how to navigate the effects of the pandemic. Travel confidence was up and partner services were setting new standards of quality. We survived. And some even thrived.

Yet, somehow, it’s tough to find anything certain about 2023. Why is that? Sure, there’s the “R” word floating around, but we’ve dealt with that before. Something about this year feels different. Why? And what does this sense of uncertainty say about the lessons from the last few years?

Simply put, uncertainty is the ultimate proving ground. 2023 is the year we find out who’s for real in the serviced accommodation industry.

Synergy made its name in earthquake country. As a result, we know the fallout starts well before the shaking begins. We know you must retrofit your foundation to survive an uncertain, shaky future. And if there’s one thing we learned over the past few years, it’s how to deliver asymmetric value in times of uncertainty.

Global Economy

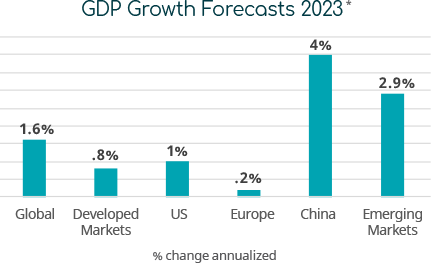

The term “recession” has dominated media headlines for the last several months. For most people, that r-word conjures the negative feelings and memories of 2009-11. So, it begs the question, is that what we’re facing today? According to the major banks and key economic indicators, not by a long shot. Goldman Sachs Wealth Management expects inflation to moderate as central banks begin the final phases of rate increases. J.P. Morgan noted the global economy is not at imminent risk of a recession.

Citibank, while defensively positioned, has readied itself for potential opportunities to unfold.

Let’s look deeper at some of the data informing these opinions…

- U.S. inflation is trending down. December’s CPI came in at 6.5 percent, down from 7.1 percent in November, marking the third straight month of falling inflation.

- The Eurozone is off to a hot start in 2023 with many experts saying it might avoid a 2023 recession altogether, and there is a current bull case for the British Pound against the Euro and US Dollar.

- Wage increases are showing a sign of slowing, and many believe the Central Banks will slow their rate increases.

- Winter COVID hospitalizations in the United States are the lowest since the start of the pandemic.

Is there cause for concern? Sure. Tragically, the war in Ukraine is showing no signs of slowing. Tensions between China and Taiwan remain high. The US government could be headed for gridlock against the backdrop of a national debt default, and the U.K. service sector is off to a very bad start. And of course, there’s the elephant in the room, seismic layoffs across the tech and finance industry. (But! Not everyone says the layoffs are as bad as the headlines will make you believe.)

Industry Takeaway: Experienced providers with positive cash flow are best positioned to maximize opportunities in times of economic uncertainty. As business valuations and lending tighten, young organizations lose the safety net of “free investment” which constricts products and service development leading to a stiff business posture.

Synergy’s Value: Synergy is not only experienced, having thrived through multiple periods of economic uncertainty (e.g. the great recession of 2009-10), it is also cash flow positive. As a result, Synergy can pivot its products and services to its stakeholders’ best interests without jeopardizing stability in other facets of its business.

Business Travel & Mobility

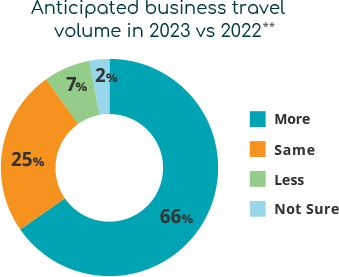

Member poll data from GBTA and WERC point to positive signs for both national and global business travel and relocations. Both domestic and international business travel are nearing pre-pandemic levels, while a strong majority of travel managers expect more business trips in 2023 (compared to 2022). On the relocation front, respondents predict a 5% increase in US relocations despite the projected 9% increase in overall relocation fees (home sale assistance leads cost categories at $36,910). Unsurprisingly, buyer value options “continued their trend” of being the most common relocation approach (65%).

Industry Takeaway: Organizations worldwide still see business travel and mobility as integral parts of their business strategy. While economic uncertainty remains a big concern for business travel managers, mobility managers project an increase in relocations. Agile, cost-effective partner business models stand the most to gain as business travel and mobility stakeholders look to limit costs and increase value across their vendor ecosystem.

Synergy’s Value: Synergy’s multi-model business model provided business travel and mobility clients alike with industry-leading flexibility and choice. The versatility and success of this approach is evident in the number of industries it serves and range of business sizes.

Serviced Accommodation Sector Themes

Sustainability

Tracking, reducing and eliminating carbon emissions dominated sector RFP questions and webinar topics throughout 2022. Refreshingly, clients pushed serviced accommodation providers

to avoid “greenwashing” and requested raw data, and measurable verifiable goals and targets.

DE&I

Much like sustainability, diversity, equity and inclusion (DE&I) metrics were prominent on client RFPs, signaling a shift in what clients expect from their partners. Clients want their supplier partners to help them achieve internal DE&I goals and objectives.

Data Security

Data breaches remain one of the greatest challenges our industry faces. Bad actors remain focused on the serviced accommodation/corporate housing industry due to the unique amount of personal and company data exchanged between clients, guests and providers.

In-apartment design

From a general perspective, apartment communities have worked hard to bring nature inside their common areas and apartment units. Eco-friendly design elements not only add value aesthetically but functionally as well in terms of mental health and sustainability.

Adding local and cultural thumbprints to communal and private living spaces is another trend we expect to continue in 2023. This trend is part of helping local culture permeate the transitory nature of temporary housing.

We expect a resurgence of Co-Living options in 2023 with a major caveat—optionality. These spaces will be designed to attract specific traveler segments as opposed to the one-size fits all approach pre-pandemic.

Broadly speaking, a major trend based on Synergy client and guest surveys is the importance of “function” over “design.” The apartment must be a multi-purpose space that facilitates employee wellness and productivity.

Technology

Fully integrated SMS-style messaging will be the preferred choice for all guest communications post-booking.

Broader data capture techniques will lead to expedited analysis/iteration cycles, which will deliver a more personalized guest experience.

Guests want more than a “take or leave it” extended-stay experience. As unique lodging experiences further permeate culture, guests have become “connoisseurs of choice.” They want more freedom to select and book temporary housing of their choosing.

In a trend that emerged last year, we expect more transferees to request housing closer to where they plan to choose permanent housing (what we call “superb suburb housing”).

Technology can’t replace what we do because we don’t just offer clients and guests apartments—we offer clients and guests an experience that just happens to be in an apartment.”

–Jack Jensky

Ripple Effects of Pandemic Investments & Acquisitions

Tough economic times have slowed the flow of investment capital into the sector. As the “free money” dries up, new entrants will face extreme pressure to produce revenue as their burn rates catch up with “growth at all costs” business tactics (e.g. undisciplined rates, scale before service, etc.). We expect a lot of new providers to either sell their assets and IP or go out of business.

Guest experience standards and guest service potential will face strong headwinds throughout 2023 as these organizations look to cut labor costs to maximize short-term revenue (or make good on an acquisition). 2023 will be the ultimate test for all tech-first business models.

Synergy Performance & 2023 Focus

Financial performance

Synergy’s industry experience and operating model proved incredibly valuable in 2022, as the company experienced its fourth straight year of double-digit YOY revenue growth (discounting 2020). The company’s APAC expansion increased technological efficiencies and investment in alternate business verticals, and revenue sources will drive the growth.

Client portfolio strength

- The company’s client portfolio beat growth targets by 7%

- Backed by a purposeful multi-year vertical diversification strategy, Synergy gained traction in new industries including aerospace, finance/banking and pharmaceuticals

- Additionally, Synergy launched a dedicated entertainment division led by a local team based in Los Angeles, CA

- Synergy grew its YOY room nights served by 50% while maintaining a 94% average guest service score (scale of 100) These service metrics prove the company’s prowess in serving the globe’s largest mobility and business travel programs at the highest level

Inventory

- Synergy opened new U.S. markets where clients heavily requested housing options most recently in Washington D.C. and Arizona

- In EMEA, Synergy added multiple properties to its portfolio in both London and Dublin

Model & Product Innovation

Synergy’s parent company, The Ascott Limited, acquired Oakwood and in doing so, enlisted Synergy’s expertise to manage multiple U.S. Oakwood locations. In a strategic decision, the properties will retain the Oakwood brand for the foreseeable future, yet Synergy’s experience and expertise will be behind the service standards and revenue production. These apartment assets provide Synergy clients with preferred inventory options in key locations worldwide.

Technology

Synergy’s technology team made great strides in 2022. Tasked with multiple critical objectives, the team delivered a successful beta test of its CodeOne platform in the U.S. and went live in EMEA. Additionally, it successfully tested SMS-based guest communication software with a key pool of clients. In the near future, Synergy will roll out CodeOne to its entire client base, taking the critical first step towards providing instant booking capabilities to the serviced accommodation industry.

Sustainability

In what can only be described as a banner year for sustainability, Synergy took great strides to meet its 2030 carbon-neutral emission target. Benchmarked against the United Nation’s 17 Sustainable Development Goals, Synergy engaged the sustainability platform GreenFeet to analyze its carbon emissions and track progress with full public transparency. Of note:

- Upgraded 85% of its vehicles to hybrid/fully electric

- Removed 30% of food waste generated from unused welcome food packs and replaced them with Uber Eats vouchers

- Eliminated 120K plastic bottles, microplastic products and

- 180K sheets of paper from core properties and office buildings

DE&I

Appointed a Global Head of Diversity, industry veteran Joan McCarthy Mack, and formed a Synergy Diversity Committee comprised of associates throughout the company. Joined other industry organizations in implementing an intern program aimed at providing career advancement opportunities to individuals from underserved communities.

Brand(ing)/Culture

In a continuing trend, Synergy won multiple industry awards ranging from service excellence to marketing to sustainability to overall industry stewardship. Notably, Synergy won Corporate Housing Provider of the Year by Forum for Expatriate Management (FEM) in both the U.S. and EMEA regions (EMMAs).

When in Times of Doubt, Choose Experience

Looking forward into 2023, we want to reiterate our commitment to serving our stakeholders with a service-first mentality, especially those individuals and families who call our apartments home. While global events and the economy remain uncertain, it’s important to find certainty in the providers you choose to take care of your most valuable asset. And what’s more certain than trust built upon past performance?

Synergy developed and perfected a unique hybrid inventory model. As a Hybrid operator, we both operate our own apartments and act as an agent, vetting the top housing solutions in the market, so we can provide housing that best meets the needs of both the client and the guest. Overall, we want you to have the benefit of choice—and therefore a say—in how you serve your stakeholders. In our experience, this is the most cost-effective way to navigate budget tightening around extended-stay program management.

Often, companies will seek cost savings on the front end of the transaction (i.e. procurement) at the expense of service standards on the back end (i.e. guest experience). The problem with this approach is it ends up costing more in the long run in both hard and soft costs.

As you form your extended-stay partnerships this year, keep in mind the asymmetrical effects employee relocations and business travel have on employee loyalty. These professional events have the power to make or break your talent pool. Don’t just choose a provider you can trust—choose the guarantee of experience.

If you are interested in learning more about how Synergy has helped organizations revamp their mobility and travel departments to be more efficient, let us know. We’d be happy to set up a call with one of our experienced business development managers.

As always, we are here to be your partner. We hope the insights and information we shared in this annual update is helpful as we head into 2023.

Debra Christopher

President, Synergy Global Housing

- * Global GDP growth in 2023 is forecast to climb 1.6%. Developed Market growth is forecast at 0.8%, U.S. growth is forecast at 1%, Euro Area growth is projected to come in at 0.2%, China’s economy is forecast to grow 4.0% and Emerging Market growth is forecast at 2.9% in 2023. Source: JP Morgan

- ** GBTA business travel recovery poll: Anticipated the volume of internal business travel such as travel to meet with colleagues or work at other company offices will be at your company in 2023 compared to 2022. Source: GBTA