Doing Business in China

Doing business in China is complicated. We won’t even try to dance around it.

It’s kind of like a relationship if you will. Do it with the right partner, and you’ll reap the benefits. Do it with the wrong partner, and it can be downright difficult.

The same goes for China’s invoice system, or “Fapiao”. Any country newcomer or seasoned financial specialist will attest to the complexities involved with Fapiao when it comes to mobility and business travel. But dig a bit deeper and the very same people will also tell you that if you follow the right process, with an experienced partner, your serviced accommodation programme could benefit from some rather significant financial benefits.

And that’s what we want, right? A top-quality, cost-effective accommodation programme.

First, let’s explore what exactly Fapiao is and how it works.

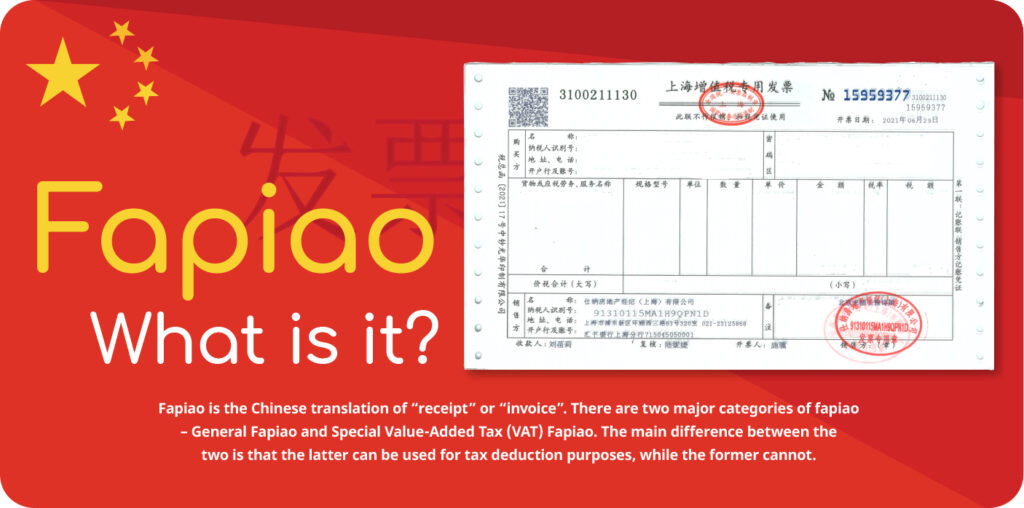

Fapiao is the Chinese translation of the English word “invoice”. Effectively a proof of a transaction, a Fapiao is issued for just about anything from clothing and food, to large accommodation rentals.

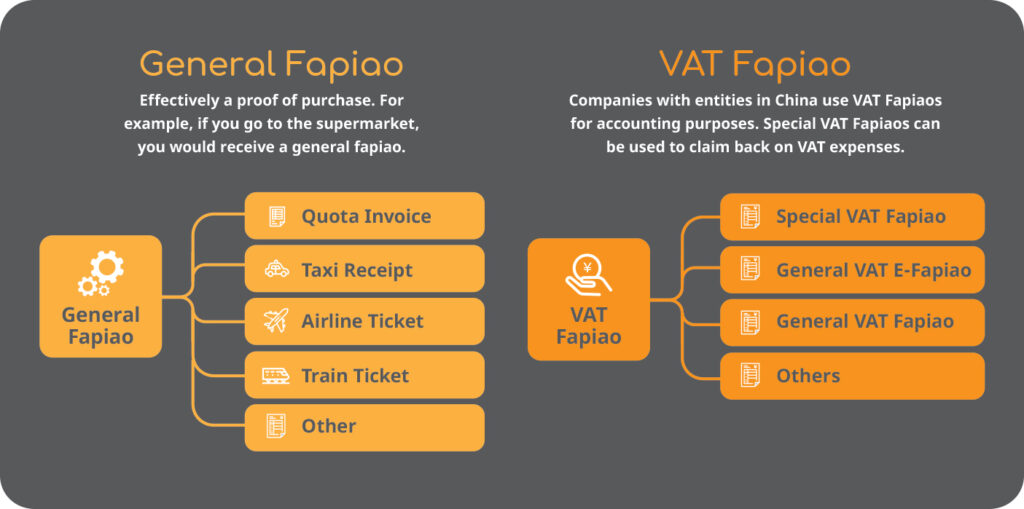

There are two main types of Fapiaos:

A General Fapiao: An invoice.

A Special VAT (Value Added Tax) Fapiao: An invoice used for tax deduction purposes.

While both types act as a proof of transaction, the main difference between the two is the latter can be used by a company to claim back on VAT expenses. This is the one you’ll want to get clued up on if you want a cost-effective accommodation programme in China.

How Does a Special VAT Fapiao work?

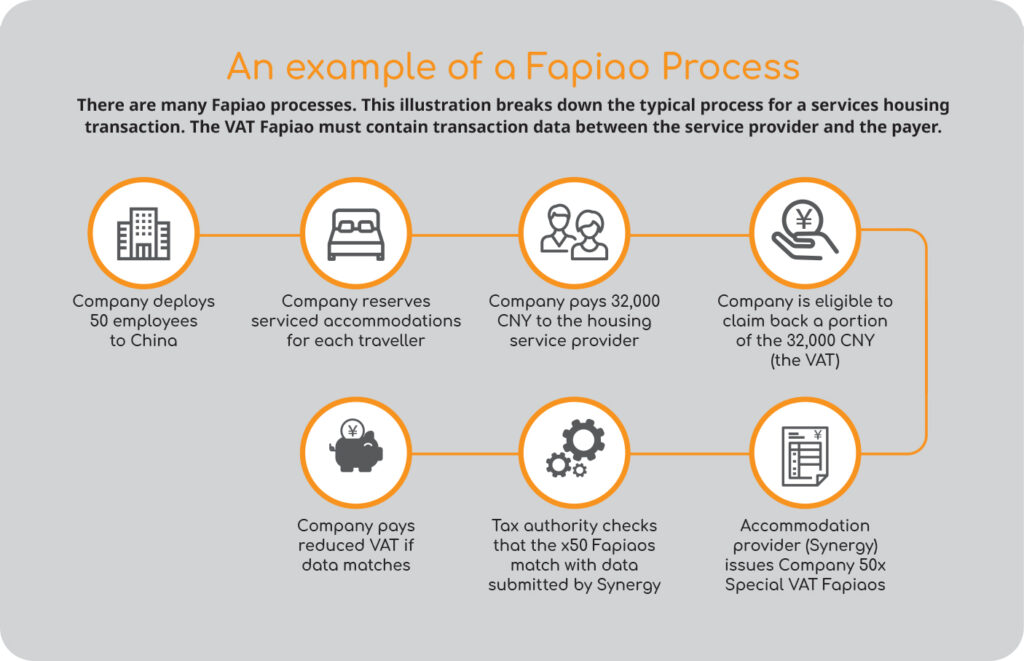

In short, after purchasing a service in China, a company will be able to use a Special VAT Fapiao to submit a claim to the tax authority on the VAT they paid for a service. Sounds simple, doesn’t it? Unfortunately, there’s a little more to it as this company will only be able to claim back on the VAT if the company who issues the VAT Fapiao, i.e. the service provider, complies with the rules and regulations set by the Chinese government.

But what are these rules and regulations? Take a read below to see some of the key elements you’ll need to consider when selecting a service provider if you want to get that all-important VAT rebate.

It’s All About Following the Process

There are a number of criteria that a service provider (i.e., a serviced accommodation provider) must follow in order to comply with the law when issuing a Special VAT Fapiao to a client. For instance, the Fapiao must be:

Compliant: The service provider must have the legal authority to issue Special VAT Fapiaos, which should be issued in compliance with Chinese tax laws.

Authentic: Fapiaos must be authentic.

Timely: The service provider must issue a Special VAT Fapiao within a specific time period, and only after payment has been made.

Relevant: There are various types of Special VAT Fapiaos. Service providers must ensure they issue the correct type for the correct transaction alongside all relevant transaction data.

Issued As Part of An Agreement: Prior to issuing the Special VAT Fapiao, all parties must agree and demonstrate to the Chinese tax authority who should issue the Fapiao (i.e., the service provider) and who should receive the Fapiao (i.e. the payer, or service receiver).

In certain scenarios, such as when a third party comes into the mix, the process of demonstrating this agreement can get complicated. But note we’ve used the word “scenario”— the way in which Fapiao works is very dependent on the scenario at hand which is why it can be so difficult to navigate. Not to mention some landlords are known to be unwilling to comply with the criteria, don’t understand the process, or will at least make it an excruciatingly painful one.

The Power of Partnership

Let’s rewind for a second. Remember when we said navigating Fapiao is like navigating a relationship? Tax and relationships don’t have much in common, we’ll give you that. But what they do have in common is the necessity for a quality partnership. And the message remains the same— choose the right partner and you’ll reap the benefits.

So, in order to keep your accommodation programme both cost-effective, in compliance with the law, and let’s be honest—as stress-free as possible—it is imperative you select an experienced and knowledgeable, on-the-ground accommodation partner who, when issuing Special VAT Fapiaos, can meet the above criteria.

Synergy is Here to Help

Navigating the serviced accommodation world in China is daunting, we get it. With Synergy’s team of local, on-the-ground Fapiao experts, we can give you the support you need to get it right.

Since 2018, Synergy has delivered a local “feet-on-the-street” service to its clients with the opening of its Shanghai entity and investment in local country, industry and Fapiao experts. In doing so, Synergy became the first international corporate housing provider to issue Fapiaos and bill in local currency. The company can now also issue e-fapiaos. Taking this step opened the door to not just significant cost savings for our clients, but the support and confidence our clients need to achieve a quality, cost-effective accommodation programme in China. And that’s what partnership is all about. It’s about support and trusting your partner to do right by you.

Whether you’re ready to dip your toe in the water, you’ve done it all before, or you simply want to find out more about how Synergy can support you, reach out to our APAC team today and find out how we can be the best partner for you.

Download our Fapiao infographic here.